Introduction

The SMC Pro System v12.0 is a comprehensive trading indicator built on Smart Money Concepts (SMC) principles, designed to help traders identify high-probability trade setups by following institutional money flow. This advanced indicator combines multiple powerful features including market structure analysis, order block detection, fair value gap identification, and multi-timeframe confirmation to deliver precise trading signals.

What is Smart Money Concepts (SMC)?

Smart Money Concepts is a trading methodology that focuses on understanding how institutional traders and market makers operate. Instead of relying on traditional retail indicators, SMC traders look for:

- Break of Structure (BOS): Key moments when price breaks through previous swing highs or lows

- Order Blocks: Areas where institutions placed significant orders

- Fair Value Gaps (FVG): Imbalances in price action that often get filled

- Market Structure: The overall directional bias based on higher highs/lower lows

Key Features of SMC Pro System v12.0

1. Break of Structure (BOS) Detection

The indicator automatically identifies when price breaks above previous swing highs (bullish BOS) or below previous swing lows (bearish BOS). These breaks signal potential trend changes and are crucial for determining market direction.

2. Order Block Visualization

Order blocks are highlighted directly on your chart with color-coded boxes:

- Green boxes: Bullish order blocks (potential support zones)

- Red boxes: Bearish order blocks (potential resistance zones)

These zones represent areas where institutions likely have pending orders, making them high-probability reversal or continuation areas.

3. Fair Value Gap (FVG) Detection

FVGs are price imbalances that occur when markets move aggressively. The indicator marks these gaps with:

- Blue boxes: Bullish FVGs (potential buy zones)

- Orange boxes: Bearish FVGs (potential sell zones)

Price often returns to fill these gaps, providing excellent entry opportunities.

4. Multi-Timeframe (MTF) Confirmation

One of the most powerful features is the MTF confirmation system. You can set a higher timeframe (default: 1-hour) to confirm that your trades align with the broader market structure. This significantly improves win rates by ensuring you’re trading with the larger trend.

5. Automated Support & Resistance Levels

The indicator automatically plots the three most relevant support and resistance levels based on recent pivot points. These levels are dynamically updated and help you identify key price zones without manual analysis.

6. RSI Divergence Detection

Built-in RSI divergence detection helps spot:

- Bullish divergence: Price makes lower lows while RSI makes higher lows (potential reversal up)

- Bearish divergence: Price makes higher highs while RSI makes lower highs (potential reversal down)

Divergence lines are drawn automatically on your chart when detected.

7. Volume Confirmation

Every signal is validated using Relative Volume (RVOL). The indicator only generates signals when volume exceeds a specified threshold (default: 1.2x average), ensuring institutional participation.

8. Smart Signal Filtering

Three signal quality modes help you customize your trading style:

- Normal Mode: Maximum signals for active traders

- Strict Mode: Filtered signals using RSI conditions

- Ultra Strict Mode: Highest quality signals only (RSI < 35 for buys, > 65 for sells)

9. Intelligent Cooldown System

To prevent signal spam and overtrading, the indicator implements a 6-bar cooldown period between signals. It also blocks conflicting signals to keep you aligned with the current market structure.

10. Complete Trade Management

Each signal comes with:

- Entry Price: Clear entry level

- Stop Loss: Calculated using ATR (default: 1.8x multiplier)

- Take Profit: Based on your risk-reward ratio (default: 2.5:1)

All levels are displayed directly on the chart with visual labels and lines.

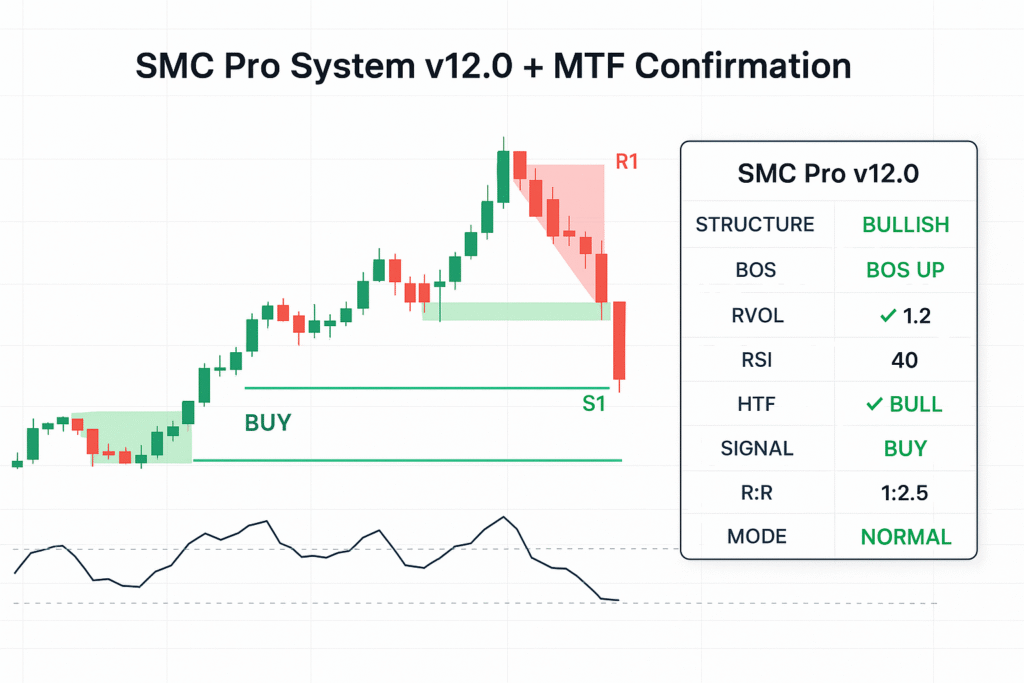

Dashboard Overview

The compact dashboard displays real-time information:

- Structure: Current market bias (Bullish/Bearish/Ranging)

- BOS: Latest break of structure status

- RVOL: Volume confirmation (✓ or ✗)

- RSI: Overbought/Oversold conditions

- HTF: Higher timeframe alignment

- Signal: Current trading signal (BUY/SELL/WAIT)

- R:R: Your configured risk-reward ratio

- Mode: Active signal quality mode

How to Use the Indicator

Step 1: Configure Your Settings

Start by adjusting the indicator settings to match your trading style:

- Signal Quality: Choose between Normal, Strict, or Ultra Strict

- Risk:Reward Ratio: Set your target R:R (recommended: 2.5:1 or higher)

- ATR Stop Loss: Adjust stop loss distance (1.8x ATR works well)

- Enable MTF: Turn on multi-timeframe confirmation for higher quality trades

- Higher Timeframe: Select your confirmation timeframe (60-min recommended for 15-min charts)

Step 2: Wait for Valid Signals

The indicator will generate BUY or SELL signals when all conditions align:

For BUY signals:

- Bullish break of structure occurs

- Market structure is bullish

- Volume exceeds threshold

- RSI conditions met (based on your mode)

- Higher timeframe is bullish (if MTF enabled)

For SELL signals:

- Bearish break of structure occurs

- Market structure is bearish

- Volume exceeds threshold

- RSI conditions met (based on your mode)

- Higher timeframe is bearish (if MTF enabled)

Step 3: Execute the Trade

When a signal appears:

- Note the entry price shown on the label

- Set your stop loss at the indicated SL level

- Set your take profit at the TP level

- Monitor the trade using the dashboard

Step 4: Use Support Tools

Enhance your trading by:

- Watching for price reactions at order blocks

- Looking for fill opportunities at FVGs

- Respecting auto-plotted support/resistance levels

- Confirming with RSI divergences when available

Best Practices

Risk Management

- Never risk more than 1-2% of your account per trade

- Always use the stop loss provided

- Consider scaling out at key levels

Timeframe Selection

- Works best on 15-minute to 4-hour charts

- Use 1-hour or 4-hour as your MTF confirmation

- Higher timeframes generally provide more reliable signals

Market Conditions

- Best results in trending markets

- Reduce position size during ranging/choppy conditions

- Watch the Structure indicator to gauge market state

Signal Quality

- Start with Strict or Ultra Strict mode while learning

- Only switch to Normal mode once you’re comfortable

- Always wait for volume confirmation (RVOL ✓)

Customization Options

The indicator is highly customizable:

- Visual Elements: Toggle order blocks, FVGs, labels, and lines on/off

- Colors: All colors can be adjusted to match your chart theme

- Sensitivity: Adjust pivot lookback periods, RVOL threshold, divergence settings

- Risk Parameters: Fine-tune ATR multiplier and risk-reward ratio

Alert System

Built-in alerts notify you when signals occur:

- “SMC BUY” alert for bullish signals

- “SMC SELL” alert for bearish signals

- Alerts fire once per bar to avoid spam

- Set up notifications on your phone or email

Who Should Use This Indicator?

The SMC Pro System v12.0 is ideal for:

- Day traders looking for intraday opportunities

- Swing traders seeking multi-day positions

- SMC enthusiasts wanting automated structure analysis

- Disciplined traders who follow rules-based systems

- Traders seeking institutional-level insights

Conclusion

The SMC Pro System v12.0 combines sophisticated Smart Money Concepts analysis with practical trading tools to create a complete trading solution. By automatically identifying market structure, order blocks, fair value gaps, and validating signals with multiple confirmation factors, it helps traders make informed decisions based on institutional behavior rather than lagging indicators.

Whether you’re new to Smart Money Concepts or an experienced SMC trader, this indicator provides the visual clarity and signal precision needed to trade with confidence. The multi-timeframe confirmation ensures you’re aligned with the bigger picture, while the intelligent cooldown system keeps you disciplined and focused on quality over quantity.

Remember: No indicator is perfect, and proper risk management is essential. Always use appropriate position sizing, respect your stop losses, and never trade more than you can afford to lose. The SMC Pro System v12.0 is a tool to enhance your trading edge—combine it with sound money management for the best results.

Ready to start trading with Smart Money? Add the SMC Pro System v12.0 to your TradingView charts today and experience institutional-level analysis at your fingertips.